Living off interest calculator

Use this cost of living calculator to compare the cost of living between US. Input your details into our living expenses calculator to find out how your living expenses compare with the national average.

Compound Interest Calculator Getsmarteraboutmoney Ca

If you are an employee you cant deduct any interest paid on a car loan.

. Currently car loans are available on interest rates ranging from 10 - 15 but there are a few banks that offer it for as low as 955. Discover the multi-award-winning King sofa collection. Account for interest rates and break down payments in an easy to use amortization schedule.

It will also show you how much you will pay in interest and fees. After that time period however it adjusts annually based on market trends until the loan is paid off. Get 105 of your premium back 3 or get monthly income from age 60 on survivalmaturity.

Average living expenses for a couple. Get claim payout on diagnosis of 64 critical illnesses 4 optional. Bureau of Labor Statistics and demographic data from the US.

Additional factors that may affect the interest rate on car loans include the loan amount loan tenure your credit history and your reputation with the bank. Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term. Use this calculator to determine how much longer you will need to make these regular payments in order to eventually eliminate the debt obligation and pay off your loan.

Please navigate via the FSA menu to find your documents rather than using the search bars as these are no longer supported. By making consistent regular payments toward debt service you will eventually pay off your loan. These deductions add up to 8200.

That 5900 is more than the 5700 closing costs Tom and Patty will pay when they refinance. You can access FSA content via the National Web Archives fsagovuk site. Accidental death benefit 5 cover up to 2 crore optional.

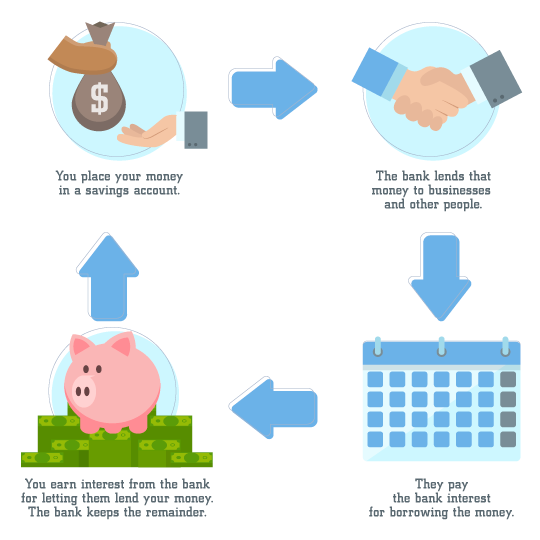

We also have various styles to match your current or future interior design from classic style to modern ones you can count on us to have the. But the longer you take to pay off your compound interest debts the higher they will become. Using a student loan calculator can help you create a student loan repayment strategy thats right for you.

Driving off with the best auto loan deal comes down to preparation. With this option your interest rate never changes during the life of the loan. CELEBRATION SALE ON NOW - UP TO 50 OFF SELECTED DESIGNS.

To build it MoneyGeek combined data from the Council for Community and Economic Researchs Cost of Living Index employment data from the US. For most cards you begin with a low rate even 0 for a. Once they save enough in interest to cover the closing costs theyll hit their break-even point.

However if you are self-employed and use your car in your business you can deduct that part of the interest expense that represents your business use of the car. Cost of Living Calculator. Living cost in Australia for one person.

Average monthly living expenses for a family of 4. Because there is only one US. Saving tens of thousands in interest.

Balance Transfer APR. From healthy diet plans to helpful weight loss tools here youll find WebMDs latest diet news and information. Shop around and compare at least three loan options and pay close attention to interest rates terms and fees offered by each.

Mortgage interest 6000 student loan interest 1000 and charitable donations 1200. Tax benefit 6 as per prevailing tax laws. Cities and determine if you will be able to maintain your current standard of living in another city.

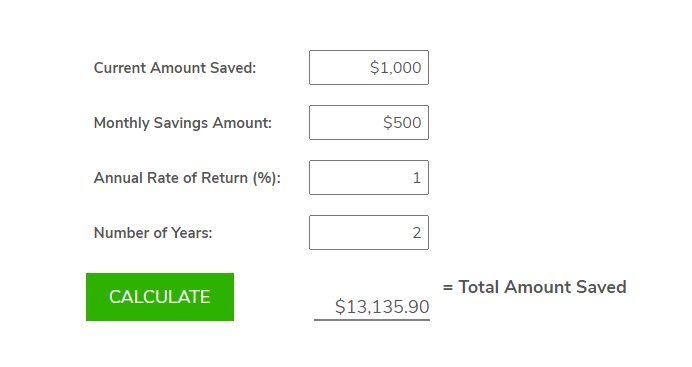

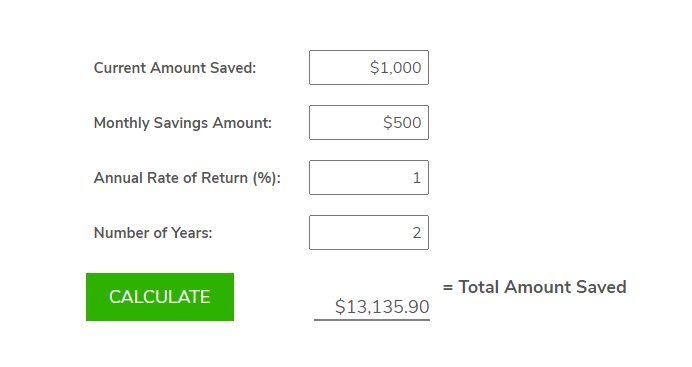

A compound interest calculator will help you determine how fast youll save money or spend money depending on your financial situation investments and debts. This balance transfer credit card calculator examines up to 5 cards and calculates when the debt will be paid off. This applies even if you use the car 100 for business as an employee.

The earlier you start saving money the better. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and. In this case you would want to take the standard deduction of 12550 instead because an additional 4350 would be deducted from your taxable income.

Choose from sofas perfect for lounging modular. This keeps you protected from the rising rates of an adjustable-rate loan. At Star Living we know that the perfect sofa looks different for everyone.

Use our free mortgage calculator to estimate your monthly mortgage payments. An MMM-Recommended Bonus as of August 2021. Then they subtract the refi interest from the original loan interest during that timeframe like this.

That is why we carry sofas in different styles and configurations offering the best fabric and leather sofas in Singapore. The interest rate does not change for the first five years of the loan. You paid 313 less interest in the second month compared to the first month and you paid 313 more towards your principal in the second month compared to the first month.

Most publications can be found under FSA Library. In May 2019 the FSA website was turned off. WELCOME TO KING Sofas.

However keep in mind that this will come with certain pitfalls. The interest rates are usually comparable to a 30-year mortgage but ARMs transfer the risk of rising interest rates to youthe homeowner. Student loans usually have high interest rates ranging from 6 and up and using a personal loan to pay off student loans will translate to lower interest rates and faster debt repayments.

Determine How Quickly You Can Pay Off Your Loan How long until my loan is paid off. With some basic information about your existing or. 21600 - 15700 5900.

The MoneyGeek calculator allows you to run cost of living comparisons of expenses in nearly 500 US. You itemize the following deductions as a single individual. Notice how your interest payment is slightly lower while your principal payment is now slightly higher.

The interest rate you owe on balances transferred from loans or other credit cards to the applicable credit card. Ensure right life cover 1 to protect yourself adequately at every life-stage 2. You will now repeat the same steps until your mortgage is fully paid.

How To Calculate Credit Card Interest Rate

How Much Money Do You Need To Live Off Interest Lendedu

Hynvk1gapgu1wm

Pin On Save Money

Free Simple Savings Calculator Investinganswers

/Compoundinterest-f0b145415f244b40bb93c82154e8343d.png)

Compound Interest Explained With Calculations And Examples

How Much Money You Need To Retire At 35 And Live On Investment Income

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Mortgage Amortization Calculator

![]()

Calculators Archive Getsmarteraboutmoney Ca

Loan Interest Calculator How Much Will I Pay In Interest

How Much Interest Will I Get On 1 Million

Compound Interest Calculator With Formula

How Much Interest Will I Get On 1 Million

How Much Money Do You Need To Live Off Interest Lendedu

Pin On Savings Budget

/Compoundinterest-f0b145415f244b40bb93c82154e8343d.png)

Compound Interest Explained With Calculations And Examples

Debt Snowball Calculator Debt Snowball Calculator Interest Calculator Mortgage Payoff